With the National Living Wage set to increase this April, we’ve put together this comprehensive guide that covers both the practical and strategic aspects of the increase from an employer’s perspective. If you’re worried about how this might affect your business or your ongoing recruitment, reach out to us today.

National Living Wage Increases UK

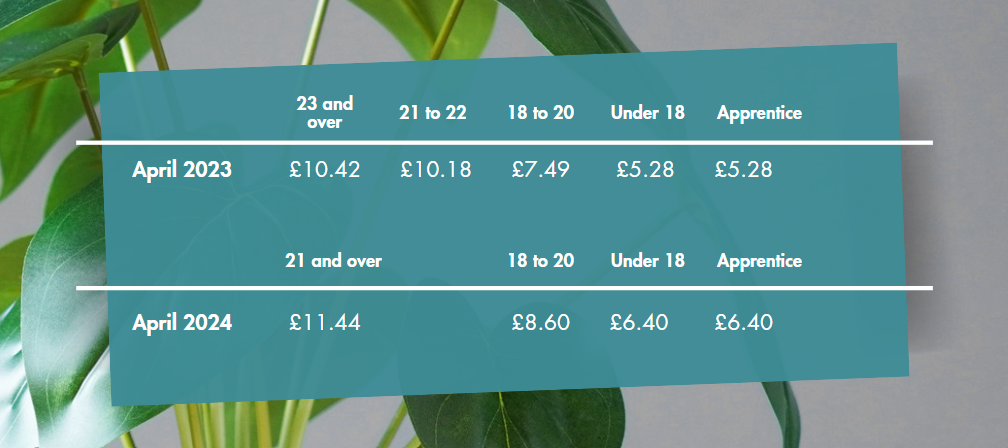

The Government's announcement of the National Living Wage (NLW) increase to £11.44 per hour for workers over 21, starting April 2024, marks a significant shift. This increase, up from the current £10.42 for workers over 23 and £10.18 for those aged 21-22, is set to impact over 2 million low-paid workers. Employers need to be prepared for the financial implications of this hike, and lots of employers are concerned around what this means for their businesses.

We’ve answered some of the most commonly asked questions about the NLW increase here:

When Does the National Living Wage Increase?

This pivotal increase takes effect from the 1st April 2024. However, it's important to note that the new rates apply from the start of the first pay reference period after 1st April. This means if your pay month runs from the 15th of each month, the increased rates don’t have to be applied until the 15th April.

When Does the National Minimum Wage Increase?

The National Minimum Wage (NMW) will also increase – in fact, this will be the largest increase to the National Minimum wage ever. The NMW, applicable to different age groups, is crucial for employers to stay compliant with the legal wage requirements. These are the current and new rates as of the 1st April 2024:

How will the National Living Wage Increase Impact Business Costs?

The NLW increase poses a substantial challenge for businesses, especially SMEs. Employers must navigate increased payroll budgets and potential impacts on profit margins, considering strategies like price adjustments or cost-saving measures. There are huge concerns that these reviews might result in redundancies or businesses struggling to run.

What are the Legal Obligations for Employers around the National Living Wage Increase?

It's really important to understand that it's against the law to pay less than the National Minimal or Living Wage. Employers must ensure that they are compliant in order to avoid legal ramifications, ensuring all employees, including those on zero-hours contracts and agency workers, are paid at least the minimum wage.

In addition to these most commonly asked questions, there are a number of other aspects to consider for businesses, which we’ve outlined below. We’d recommend facing these issues before the 1st April so that you are prepared once the change comes into effect.

Pay Differentials

Maintaining pay differentials is a complex issue in itself and, with the NLW increase, employers will likely need to adjust wages of other employees to maintain a hierarchy and morale within the workforce.

Sector-Specific Challenges

The impact of the National Living Wage increase will vary across sectors. Industries with a high proportion of minimum wage workers, like retail and hospitality, may face more significant challenges compared to others.

Strategies for Employers

Employers can adopt various strategies to manage the increase, such as enhancing productivity, investing in employee training, and re-evaluating business models.

Compliance with New Employment Laws

2024 also introduces new employment laws including rights to paid neonatal care leave and regulations on tips. Employers need to stay informed and compliant with these changes. We are pleased to offer up to date advice and support to employers who may not be aware of how these changes will affect them – send us an email and we’ll arrange a meeting.

Zero Hour Contracts

The 2024 increase will also affect those on zero-hour contracts. They are entitled to the National Minimum Wage and National Living Wage, just like other workers. With the increase in the NLW, employers will need to ensure that all their staff, including those on zero-hour contracts, are paid at least the new minimum rates. This change could lead to increased costs for businesses that rely heavily on zero-hour contract workers, particularly in sectors like retail and hospitality. It's crucial for these employers in particular to review their payroll and adjust their budgets accordingly to comply with these legal requirements.

The National Living Wage increase in 2024 presents a complex mix of challenges and opportunities for UK employers. It's essential to not only understand and comply with these changes but also to consider the broader implications and potential benefits for your business and workforce.

Despite the challenges, there are potential benefits. A fair wage can lead to improved employee morale, reduced staff turnover, and increased productivity. Paying a real Living Wage, which is higher than the National Living Wage, can further boost staff productivity and motivation, positively affecting the employer's brand and bottom line.

And on top of that, we must consider the broader economic implications as a result of this change and the potential effect on inflation, consumer spending, and overall economic growth. Although initially the increase could cause a few headaches, in the long run – we see this as being a positive change, and we’re here to help you see it through. If you’d like to discuss your strategy for managing the increase with any of our recruitment experts, please do reach out to us today on 01225 777157 or send us an email: recruitment@wh-employment.co.uk - we look forward to speaking to you!